A process to ensure you feel protected.

Designing customized risk management solutions tailored to your unique needs.

Home »

Studies show that most consumers do not have the time or ability to properly identify and manage risk. Meanwhile, many agents have failed to support consumers with a process to uncover, analyze, then mitigate risk issues. This has eroded the perception of value in the traditional insurance process for many business leaders, individuals, and successful families.

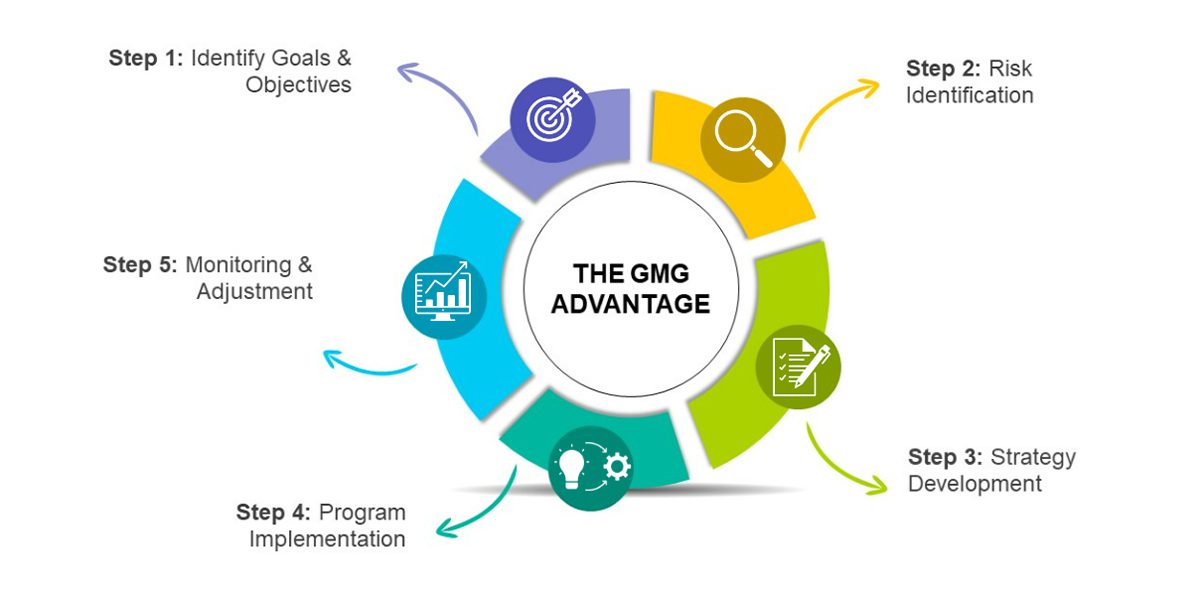

At GMG Insurance, we know you are more than an intangible insurance policy. Your risk management program to address life’s uncertainties should not be restricted to simply an insurance quote. That is why we have designed The GMG Advantage: a proprietary risk management process curated to your unique situation and needs.

The GMG Advantage creates peace of mind knowing that you have an advisor dedicated to improving your risk profile. This consult, diagnose, then treat process can lead to improved workplace culture, enhanced profitability, reduced total cost of risk, and more favorable terms in the underwriter marketplace.

To find out how this process reduces claim frequency and severity, read below:

Step 1: Identify Goals & Objectives

No two organizations or family living situations are identical. That means it is critical to understand your risk tolerance before designing an effective risk management program. Through an initial consultation, the GMG team gains an appreciation for your current and future needs. This collaborative process becomes the foundation of the resulting risk management roadmap, today and in the future.

Step 2: Risk Identification

Based on your personal or professional goals and objectives, we move to step 2, risk identification. This is the most exciting part of the process for the GMG team because we invest in the resources necessary to learn all about you, or your organization. This discovery process is customized based on the size, scope, and complexity of risks for those who we serve. This process might include onsite tours of the property, confidential interviews, employee benefit data analysis, policy and procedure reviews, or more!

Step 3: Strategy Development

Many consumers understand the process of “risk transfer:” which is transferring the risk to an insurance company using insurance policies. But we understand there are several additional (and sometimes more cost-effective) strategies to manage your risk including avoidance, retention, or reduction. Our recommendations regarding how to manage your risks are based on our initial risk identification process. This customized solution now becomes your blueprint as much as it is ours for improved protection.

Step 4: Program Implementation

The deliverables we agree to address are deep-rooted in the understanding that “Rome was not built in a day.” We view each client through a multi-year lens, ensuring that we crawl, walk, or run at a pace that is on par with your level of comfortability towards containing and controlling your total cost of risk. During this stage of the process, we craft new policies or procedures, provide training and education, and negotiate with underwriters for the most favorable terms to support your needs.

Step 5: Monitoring & Adjustment

We view each relationship as a long-term opportunity to provide guidance and resources to operate in a more risk-averse world. This means we remain agile by making appropriate updates to your risk management program so you can rest assured that wherever life takes you, GMG Insurance is poised to support you along your journey.

The GMG Advantage is reserved for organizations, individuals, or successful families looking for a long-term partnership with an advisor keen on delivering protection. If you would like to learn more about this unique process, contact a GMG Risk Advisor today.

Get Started Today

As an independent agency, we are here to help you find the right The GMG Advantage coverage.

Connect With a GMG Advisor

As an independent agency, we are here to help you find the right coverage.

Start Inquiry

It only takes a minute to get started.

- Fill out the form, we’ll be in touch.

- Review options with an agent.

- Get the coverage you need.