When it comes to buying your next vehicle, many factors come into play – design, performance, fuel efficiency, and increasingly, the cost of insurance coverage. A recent analysis by the Insurance Institute for Highway Safety (IIHS) sheds light on an often overlooked aspect of vehicle ownership: the average cost to repair your vehicle after an accident. Higher repair costs could impact your insurance renewal after you experience a claim. This comprehensive study sheds light on which makes and models cost more than the average car to repair and get back on the road.

Key Factors in Collision Losses

The report focuses on two primary metrics to assess collision losses: claims frequency and claim severity (the cost of the claim). For every 100 vehicles insured in a year, there were, on average, about 6 insurance claims, with an average claim cost of $7,579. These figures, however, vary significantly based on vehicle size and type, as well as the specifics of the collision.

The Impact of Vehicle Size

A striking finding from the data is the correlation between vehicle size and collision losses. Larger vehicles, including four-door cars, sports cars, luxury cars, and luxury SUVs, typically show above-average losses. This trend underscores the importance of considering potential insurance costs when opting for larger vehicles.

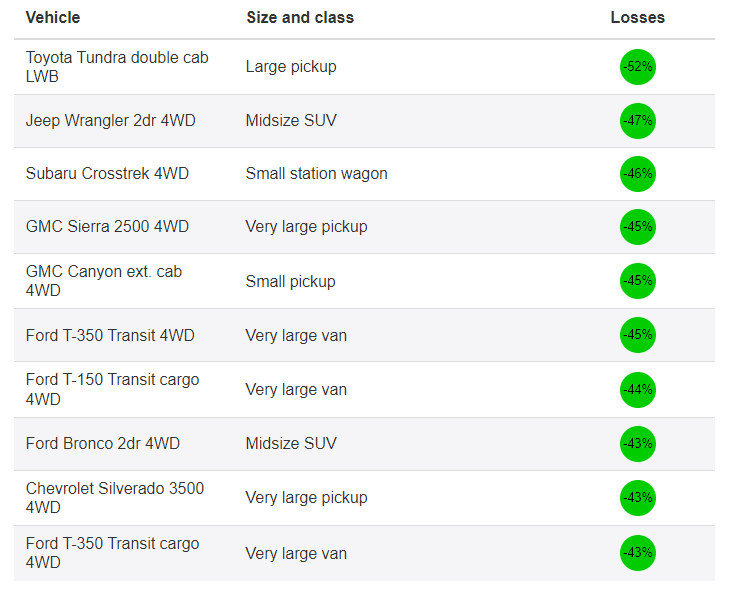

Vehicles with the Lowest Collision Losses

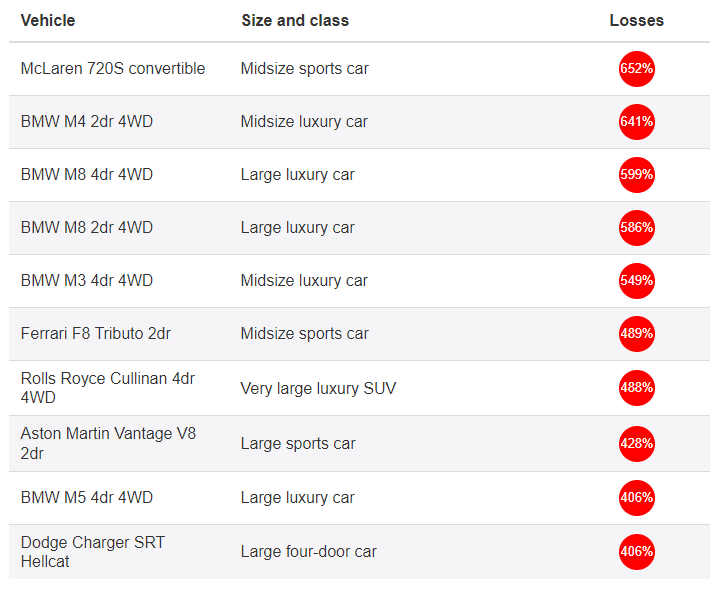

Vehicles with the Highest Collision Losses

Vehicles with the Highest Collision Losses

Understanding the Data

The percentages in the report showcase the importance of understanding vehicle safety, costs to repair, and potential insurance implications in the event that you need to file a claim in the future. The percentages shown above highlight the average collision repair costs when compared to the average for all passenger vehicles. Adjustments are made in the data to account for non-vehicle factors like operator age, gender, marital status, and more, ensuring a more accurate representation of vehicle-related losses.

Insurance Losses by Make and Model

The IIHS report goes beyond just collision coverage, encompassing a range of insurance coverages including property damage liability, comprehensive, personal injury protection, medical payment, and bodily injury. You may click here to view the various claim scenarios and respective vehicle data.

Looking Ahead

As automakers continue to innovate and redesign, the insurance loss experience of previous models can offer valuable lessons. And, while the IIHS report provides a snapshot based on past data, it’s important to remember that vehicle redesigns and technological advancements can alter the insurance loss landscape. Consumers and industry professionals alike should stay informed about these trends to make educated decisions.

Vehicles with the Highest Collision Losses

Vehicles with the Highest Collision Losses